https://earth-investment.com/wp-content/uploads/2021/05/ppp-1500x952.jpg

https://earth-investment.com/wp-content/uploads/2021/05/ppp-1500x952.jpg

The International Energy Agency (IEA) released a report in May 2021 entitled “Net-zero by 2050: A Roadmap for the Global Energy Sector”. The report is trying to provide a roadmap for policy makers on what steps are required to get to net zero by 2050. It seems to describe a scenario in which many assumptions are made which have a very wide set of possibilities to get to a net zero energy system by 2050. For example, they assumed that beyond 2030 new technologies, which are now at an embryonic stage and have yet to be proven, will be used commercially, as well as a need for considerable change in consumer behaviour in order to curb carbon footprints and emissions. Nevertheless, we believe the report will be used as a blueprint for policy makers to justify putting even more pressure on oil companies, financial institutions, and the sector, and urge them to stop investing in, and financing any new projects or exploration.

In that respect the report is negative for the oil sector in the long term, but it does not change our views and positioning in the near term. We agree that eventually oil demand will flatten and turn negative, as renewable power replaces oil demand for transportation, perhaps from 2028 or 2030. By accelerating the energy transition the oil demand peak may happen a year or two sooner, but in the near term the outlook for oil prices and the sector is very positive. The reaction to this report by oil companies, investors and financial institutions may contribute to a dampening of investment in exploration and new field developments, the supply of oil globally may contract even more rapidly and, in the short term, may exacerbate the supply-demand deficit and lead to an even faster recovery of oil prices (see below).

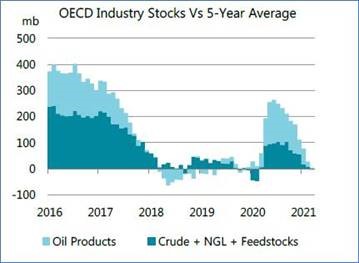

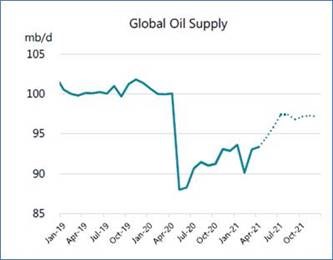

The OECD inventories are draining faster than expected, and are already below the 5-year average, before an anticipated surge in demand over this summer during the driving season as pent-up demand for travel hits the markets. The OPEC+ supply continues to be well managed, while non-OPEC supply growth (US shale oil primarily) has slowed down significantly due to pressure from investors to reduce growth and improve shareholder returns. Therefore we expect tighter supply/demand balance and higher oil prices for the remainder of 2021.

Source: IEA (Oil Market Report, May 2021)

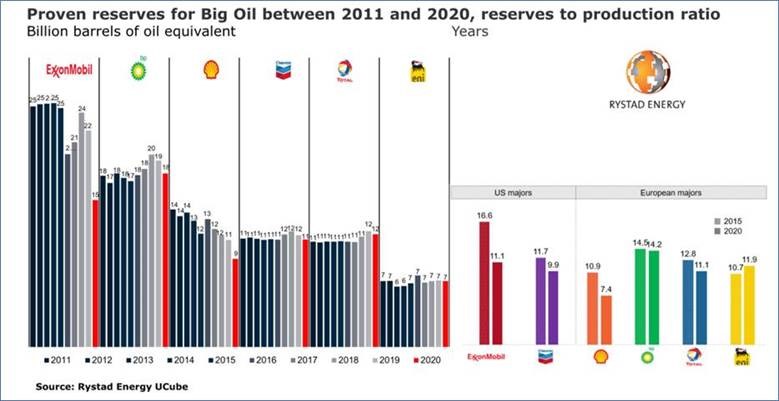

The surge of investments in renewables, as a core part of the energy transition, will continue in the meantime but for the next several years, we do not expect that this will curb oil demand growth and the oil price outlook. Lack of investments in the oil sector and a continuation of strong oil demand growth from emerging markets, driven by population growth and industrialisation, could actually cause oil supply shortages in the medium term and oil price spikes before we see the oil demand peak. We are already seeing falling reserve life from major oil companies, as they have already reduced investments:

In conclusion, we think the IEA report is a long-term idealistic roadmap which will put more pressure on the oil sector, but has no real implications for the near term. If the IEA’s net-zero scenario gets adopted by policy makers it could actually curb investments in the oil sector even further and create more oil price volatility.