https://earth-investment.com/wp-content/uploads/2025/07/IMG_8049-1500x1125.jpg

https://earth-investment.com/wp-content/uploads/2025/07/IMG_8049-1500x1125.jpg

President Donald Trump’s decision to impose a 50% tariff on imported copper aims to strengthen the domestic copper industry. The increase in the price of imports is intended to make US producers more competitive, which could boost investment and domestic consumption. This measure opens up the opportunity for higher sales and improved margins for U.S. copper producers – especially if foreign suppliers cannot pass on the additional costs to their customers in full. In addition, new investments in domestic extraction and processing could be stimulated, creating jobs and promoting industry growth.

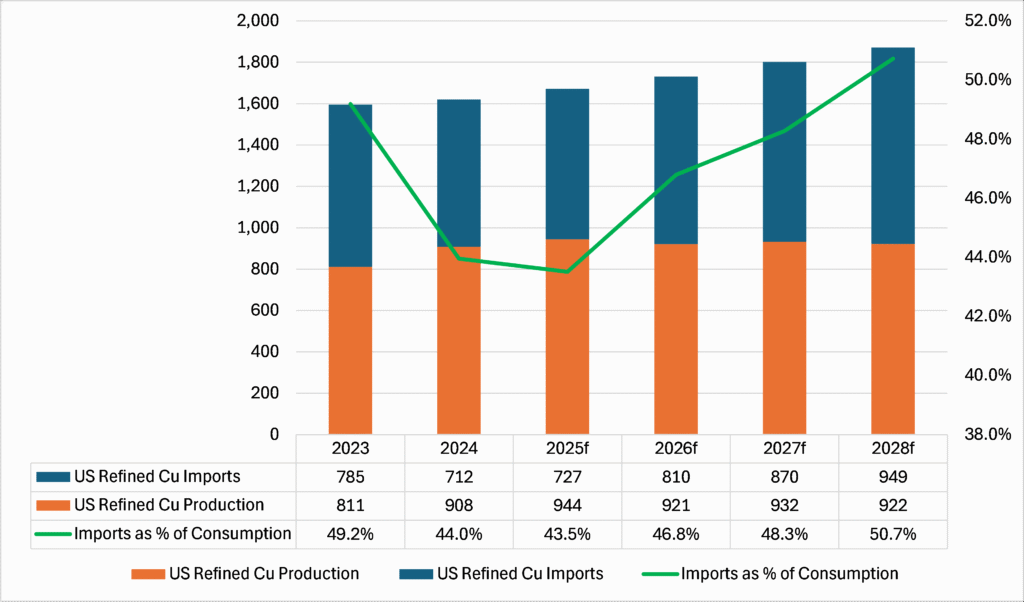

However, the tariff also brings risks: higher costs for copper-dependent industries (such as construction, electronics or vehicle construction) and possible retaliatory measures by trading partners. A look at the structural market balance shows that historically, the US imports around 44 to 50% of its refined copper needs (see Fig. 1). This means that even with more substantial domestic incentives, the country remains dependent on foreign supplies for the time being. The long-term outcome of this policy will depend mainly on how market participants – producers, consumers and international partners – respond to the changing trading environment.

In addition, structural copper demand is increasing – not least due to investments in AI infrastructure and data centres. In this context, the U.S. dependence on imports could even increase. The lasting effect of the tariff measure depends on the reaction of global markets and the domestic industry.

Source: S&P Global Market Research

Approximately 70% of U.S. copper is produced in Arizona, where we recently visited four copper projects. These will increase copper cathode production by 280 kt in four to six years, reducing the deficit to around 30%1. The most advanced project is Taseko Mines’ Florence copper project, which will benefit the most as the first cathode production is planned for Q4 2025.

Theoretically, tariffs drive up prices and thus create incentives for new production. However, miners are planning for the long term, and tariffs could disappear as quickly as they come. Until then, the Earth Funds investments in short-term projects will likely benefit from the uncertainty and upward pressure on copper prices.

1 Copper World: 85 kt Cu from Hudbay Minerals, Cactus Project in Arizona Sonoran: 105 kt Cu, Ivanhoe Electrics Project Santa Cruz: 60 kt Cu and Project Florence from Taseko Mines: 40 kt Cu.