https://earth-investment.com/wp-content/uploads/2025/09/oil-pump-jack-sunset-clouds-silhouette-162568.jpeg

https://earth-investment.com/wp-content/uploads/2025/09/oil-pump-jack-sunset-clouds-silhouette-162568.jpeg

The International Energy Agency’s (IEA) recent report, ” The Implications of Oil and Gas Field Decline Rates[1],” highlights a critical, often overlooked reality: Maintaining global oil and gas supply depends less on demand forecasts and far more on the accelerated decline of existing fields.

In contrast to the public debate, which focuses heavily on the development of demand, the real challenge lies in the natural decline of production capacities. Since 2019, almost 90% of investment in the upstream sector has only gone into maintaining existing production and not into expansion of new production capacity. With an annual investment volume of around USD 570 billion, the industry is effectively treading water. Any significant decline in these investments could tip the system from slight growth to a real decline.

The global production structure has changed significantly over the past two decades. Conventional oil, which used to dominate, now accounts for just over three-quarters of production. The share of tight oil, especially from the USA, is increasing. Around 30% of natural gas now also comes from unconventional reservoirs.

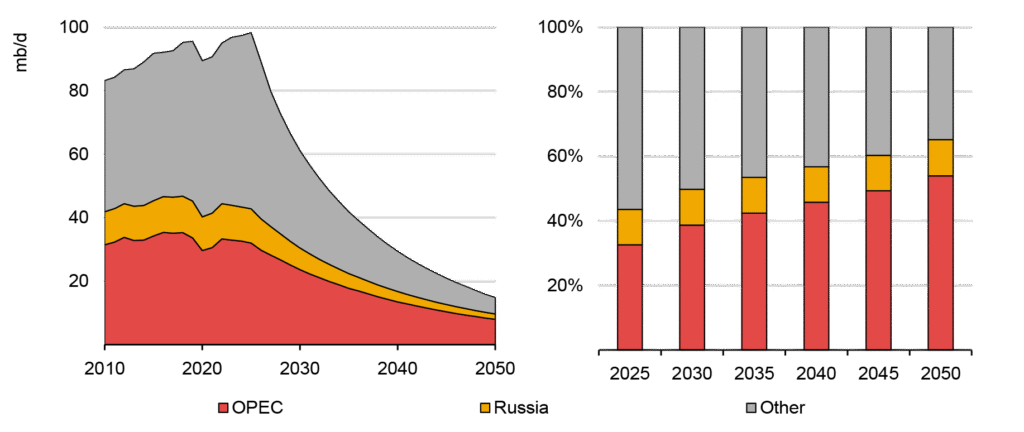

Despite this diversification, global supply remains highly concentrated. Many of the so-called “supergiant fields” are outdated. More than half of today’s oil production comes from fields that are less than 20 years old and a quarter of production is still based on fields that have been in operation for over 50 years.

Decline rates vary greatly according to the size, location and age of the fields. While supergiant fields are showing comparatively stable declines, smaller and offshore projects sometimes lose more than 10% of their production rates annually. Onshore fields in the Middle East are particularly stable. Offshore installations in Europe, on the other hand, display the highest declines. Decline rates increase with age, especially in the late phase of the fields, when water or gas production increases.

Natural Decline Rates for Global Oil Production in Selected Regions until 2025

Source: IEA (mb/d = million barrels per day)

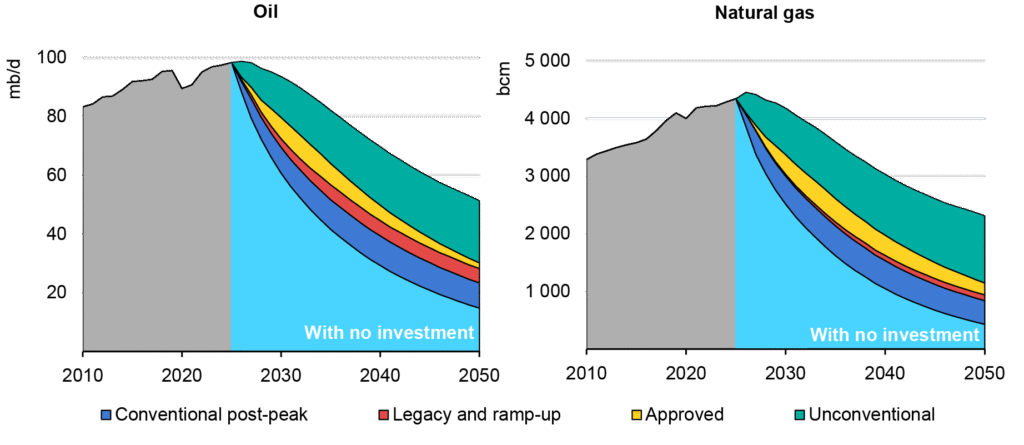

Without new investment, global oil production would decline by about 8% annually and gas production by about 9%. Unconventional resources such as tight oil and shale gas are particularly affected, with declines rates of over 35% in the first year. Developed countries that rely heavily on such sources (such as the US) could lose up to two-thirds of their production over a decade. Even robust regions such as the Middle East or Russia would face declines of around 45% significantly increasing geopolitical risks.

In order to maintain today’s production level until 2050, more than 45 million barrels of oil per day and around 2,000 billion cubic meters of gas would have to be replaced worldwide. While known but not yet approved for development resources may contribute, new discoveries are essential. Around 10 billion barrels of new oil reserves and 1,000 billion m³ of gas are required annually. This is slightly above the current level of discovery. The time from the granting of a licence to the first production is now almost 20 years on average. Early approvals and infrastructure connections (“tie-backs”) are therefore crucial.

Current investments reflect this reality. The majority goes into maintaining existing production and developing conventional fields. The Middle East is gaining in importance because of its low production costs, even though North America remains the leader in absolute investment volume. While exploration costs have risen sharply since 2015, development costs, especially for offshore projects, have fallen thanks to standardization and digitalization. The economics of shale projects have improved significantly, with break-even prices falling from over USD 90/barrel in 2014 to around USD 50/barrel today. But with rising service costs and limited premium acreage, challenges are returning.

In order to cushion declines, enhanced production methods are increasingly being used,: These include infill drilling, water flooding, gas lift and CO₂ injection. Infrastructure-related developments (“tie-backs”) offer cost advantages around established central production hubs such as the North Sea or emerging regions such as Guyana. Although EOR (Enhanced Oil Recovery) is still limited worldwide, it can have significant effects at the field level.

The political and security implications are clear. Without continuous investment, supply shifts to a few regions with low decline rates, increasing geopolitical dependencies and market risks. Governments should therefore prioritise early approvals for low-emission, fast-to-implement projects and diversify import sources. For operators, the focus is on brownfield investments, accelerated tie-back developments, and disciplined shale production. Investors, on the other hand, should include decline rates and capital requirements in their valuations – and give preference to projects with lower structural decline.

Projected oil and gas production without investment in new projects

Source: IEA (based on data from Rystad Energy)

Decline rates are not a marginal technical issue. They are a central factor for the future of energy supply. Anyone who plans energy policy, investments or market strategies without this understanding risks making wrong decisions in an increasingly volatile and resource-limited world.

[1] IEA: The implications of oil and gas field decline rates