https://earth-investment.com/wp-content/uploads/2024/05/Oxidized-copper-sulphates-visible-10_Matheo-T3-high-grade-stock-pile_02.23-1500x844.jpg

https://earth-investment.com/wp-content/uploads/2024/05/Oxidized-copper-sulphates-visible-10_Matheo-T3-high-grade-stock-pile_02.23-1500x844.jpg

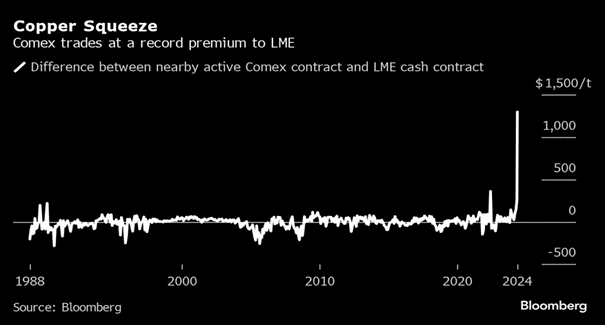

The rise in the price of copper and the increasing volatility in the futures market observed in May 2024 support the deficit on the supply side that we predicted and often reported. The price differences between the various metal exchanges in the world are usually in the range of a few US dollars per tonne. In recent days, however, the differences between the Comex Exchange in New York and other metal trading venues in the world have skyrocketed to over 1,200 US dollars per tonne. This is due to a so-called “copper short squeeze”, whereby the sharp rise in copper prices (due to a tight market) caught short sellers on the “wrong foot”. They then have to cover their short positions with physical copper to cover the expiring futures contracts. This short squeeze brought significant unrest to the market and increased the focus of metal traders on the longer-term outlook. European, Chinese and Latin American traders are now accelerating their efforts to bring physical metal to the US, but this is becoming increasingly problematic due to a tight physical market (see e.g. our discussion in the Q1 quarterly report on the Earth Exploration Fund UI).

The coverage of short positions in the futures market has caused the difference in “contract prices” on the various exchanges to skyrocket

Source: Bloomberg

We pointed out the tense situation in the copper market for some time now. The tight supply and the loss of larger copper volumes from major mines in Latin America are now leading to the first major distortions in the metal markets. The low inventories worldwide can hardly cushion such fluctuations in supply and demand. In our opinion, the shortage of copper supply and the sharp increase in demand will lead to further rising prices and what we are currently observing could be a foretaste of what awaits us in the coming years. Good times should therefore lie ahead for copper producers. The limited organic growth of many producers will lead to further acquisitions in the copper sector. BHP’s takeover bid for Anglo American at the beginning of May made this clear and joins a long list of acquisitions that have taken place in recent months. In our opinion, medium-sized producers with solid growth potential will outperform in such an environment.