https://earth-investment.com/wp-content/uploads/2025/10/teaser-image-1500x1028.jpg

https://earth-investment.com/wp-content/uploads/2025/10/teaser-image-1500x1028.jpg

South Africa is known for its rich mineral resources and mining remains a cornerstone of the economy and a significant source of foreign exchange earnings. Although the contribution of mining to GDP has declined from a peak of 20% in 1980, it is still substantial at around 6%. Mining also accounts for almost 30% of total exports, with PGMs (platinum group metals) and gold being the largest contributors.

The mining sector employs about 470,000 people, which is about 3% of the total labor force. Most of these jobs are located in rural areas where alternative employment opportunities are limited. In addition, every job in mining indirectly creates around 10 additional jobs in supporting industries such as transportation, construction, retail, hospitality, and financial services. These employment chains still underline the central role of mining in economic stability and development in South Africa.

The link between mineral exports and GDP is clearly visible: a 1% increase in mineral exports leads to an increase in GDP of about 1%. Especially in the case of gold, which is currently at record highs, the contribution of mining to GDP is expected to increase again. Rising commodity prices can also expand mineral reserves and extend the mine life, as higher prices may make lower grades economically viable. However, these opportunities also face problems, as larger, lower-grade reserves also lead to higher operating costs and require additional capital investments.

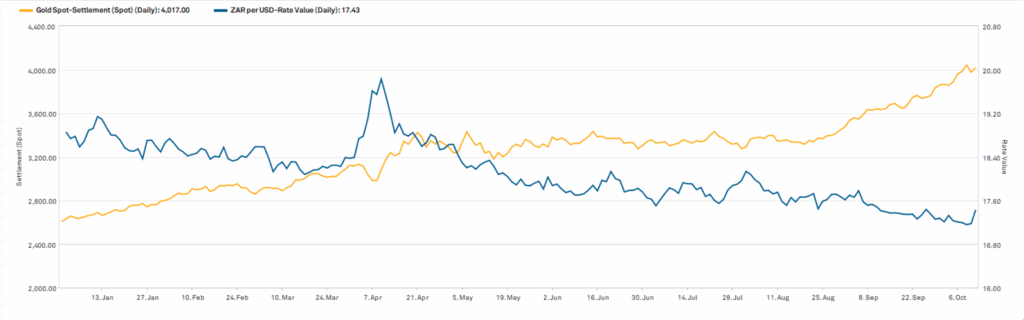

The South African mining industry faces a variety of challenges. Eskom’s outdated power supply infrastructure has regularly led to load curtailments, which affect production. Trade union strikes, which have often been violent in the past, have made stability even more difficult. With decreasing reserves and decreasing ore grades in the mines, they have to mine increasingly deeper ore, which increases costs and affects profitability. Rising commodity prices inevitably lead to a stronger Rand, which makes exports more expensive. The controversial new mining law is also causing uncertainty, as it inhibits investment and poses regulatory challenges for the industry.

Illustration 1: Relationship between the price of gold and the ZAR USD exchange rate

Source: S&P Global CapIQ Pro

Faced with these challenges, mining companies in South Africa have developed innovative solutions. Many companies, such as Harmony Gold, is investing in its own power generation through photovoltaic parks to reduce dependence on Eskom and reduce operating costs. For example, Harmony Gold plans to install 583 MW of solar capacity by 2028, with a 100 MW plant already under construction. Such investments not only help reduce costs but also reduce greenhouse gas emissions and promote sustainable practices in mining.

The Mponeng mine, the deepest mine in the world, also shows that with advanced technology and innovative cooling processes, it is possible to expand mining to extreme depths. The use of ice plants, which produce 6,000 tons of ice per day, allows for cooling of work areas and improves the safety and efficiency of mine operations.

The development of workers’ rights was significantly influenced by the formation of the National Union of Mineworkers (NUM) in 1982. After the end of apartheid, safety and health standards improved considerably, but this progress was often accompanied by protracted and sometimes violent strikes. The establishment of the Association of Mineworkers and Construction Union (AMCU) led to intermittent conflict, but now all parties are moving towards dialogue and cooperation to improve working conditions and minimise conflict.

The proposed new mining law is one of the biggest challenges facing the industry. Critics, including the Minerals Council, argue that the bill hinders investment and makes it more difficult to create new jobs. Unclear regulations regarding changes of ownership and the possibility that small and ‘artisinal’ miners accessing private land without adequate compensation create uncertainty.

However, the Department of Mineral Resource and Energy (DMRE) emphasizes that the bill is necessary to promote change and improve the economic participation of historically disadvantaged South Africans. Both sides are willing to cooperate, but political developments could have a significant influence on the future direction. The coming months will determine whether South Africa can turn regulatory risks into new opportunities for stability and growth.

The big names in the sector have repositioned themselves: AngloGold Ashanti and Gold Fields have largely divested of their South African mines and are expanding internationally. This created opportunities for companies such as Harmony and Sibanye-Stillwater, which have taken over and are now successfully operating these mines. However, this growth model has reached its limits and new opportunities must be sought organically (e.g. by deepening the Mponeng Mine to over 4,000 meters) or internationally.

Given the lack of suitable acquisitions in the gold sector, gold mining companies have also identified opportunities in other commodities: e.g. Harmony in the copper sector or Sibanye-Stillwater in the PGMs. Harmony’s recent acquisition of MAC Copper serves as an example. In the platinum sector, however, the possibilities for international expansion are limited, as 90% of the platinum reserves are located in South Africa. Companies such as Zimplats (Impala Platinum) and Valterra Platinum are already active along the Great in Zimbabwe, the only significant PGM resource outside of South Africa and Russia. After a difficult period, determined by a prolonged slump in platinum prices, the industry is only now moving into cash-plus territory. This opens up an attractive window of opportunity for investors: The sector could be at a turning point where operational efficiency, rising metal prices and strategic diversification work together – and new value creation potential emerges.

South African mining is facing significant technical, political and economic challenges. Nevertheless, the extensive mineral deposits and the innovative strength of the companies offer opportunities for sustainable growth and investment. Through technological advances, sustainable practices and constructive cooperation between government, companies and trade unions, the sector can continue to maintain and expand its role as a major economic factor in South Africa.

For investors, this opens up the opportunity to participate in a possible renewal of the sector and to benefit from the next upswing in the commodity cycle.

Image courtesy of Harmony Gold Mining Company.