https://earth-investment.com/wp-content/uploads/2023/05/iStock-1171495075-1500x844.jpg

https://earth-investment.com/wp-content/uploads/2023/05/iStock-1171495075-1500x844.jpg

When the 28th Conference of the Parties (“COP 28”) heralded a new era for nuclear energy last December, uranium producers and explorers awoke from a long slumber following the Fukushima disaster in 2011. The flooding of the Japanese nuclear reactor in 2011 led to a freeze in many global nuclear power programs. Germany, for example, decided to phase out nuclear energy just three months after the disaster. Although other countries were less rigorous (China, for example, continued to expand nuclear power despite the nuclear disaster in Japan), nuclear power faded into the background as an essential component of the global energy mix.

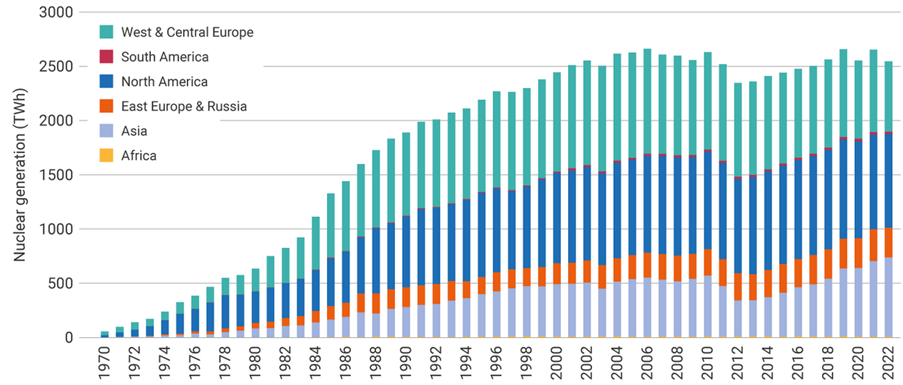

This changed with the focus on CO2-free energy generation and “net-zero” strategies, culminating in the decision that nuclear power should form an essential part of the future global energy mix (except in Germany). A key outcome of COP 28 is the planned tripling of nuclear power by 2050 from around 2,500 TWh (2020 basis) to 7,500 TWh. Such an expansion of nuclear power must be viewed with great scepticism, as there are bottlenecks and a lack of resources at many levels to implement this very ambitious strategy.

Source: World Nuclear Association, IAEA PRIS

A tripling of global electricity generation from nuclear energy by 2050 would correspond to an average annual growth of 2.3%. Over 60 nuclear reactors are currently under construction (21 of them in China) and a further 110 are currently planned (70 of them in China). The lifetimes of reactors are also to be extended and the development of smaller and cheaper Small Modular Reactors (SMRs) is to be promoted. But apart from the need for more technical expertise (e.g. engineers), there are signs of escalating costs in many projects (e.g. the construction of the Hinkley Point C reactor in England). The time-consuming issuing of licenses for constructing new power plants is also likely to call the timetable into question. The amount of missing fuel (uranium) must also be viewed critically, as the decades-long hiatus in exploration and construction of new mines makes it hard to imagine how the growing demand will be met.

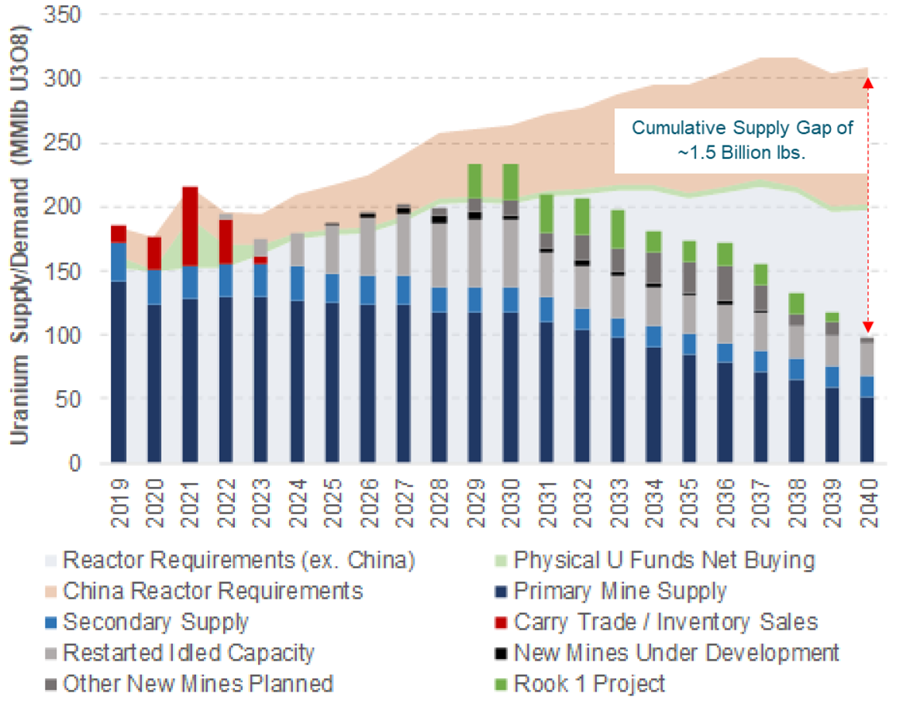

Source: Cantor Fitzgerald, Sprott

One of the biggest bottlenecks in expanding of nuclear energy is the production of enough uranium to operate the planned reactors. After more than a decade of stagnating investment in exploration and construction of new mines, uranium producers and explorers have a considerable gap to fill. China is one of the first countries to recognise this and wants to tackle the coming bottlenecks. Beijing is focused on expanding its uranium supply, by producing a third of its uranium requirements domestically, procuring another third by investing in foreign mines and buying the rest on the market. An aggressive expansion policy is emerging: the China National Uranium Corporation (CNUC) and a subsidiary of CGN – the China General Nuclear Power Group – have already acquired stakes in mines in Niger, Namibia and Kazakhstan, for example, while the CNUC is building a storage facility in Xinjiang near the Kazakh border that will serve as a vital uranium trading centre. China’s desire to secure uranium supplies should be a warning signal to the West, which has had to rely on Russia, which controls almost 50 percent of the world’s uranium enrichment capacity. Introduction of the planned SMRs essential. However, these sources are increasingly under threat due to escalating tensions with Russia. Many Western countries recognize this, above all the USA, which wants to sanction the supply of enriched uranium from Russia. For example, the United Kingdom and the USA have announced that they will invest up to USD 500 million to increase the production of highly enriched uranium fuel. This fuel is currently only produced commercially in Russia and would also be essential for introducing the planned SMRs.

The West will increasingly need to focus on its own uranium production and enrichment, requiring significantly higher uranium prices than we have seen in recent years. For example, the management of Uranium Management Corporation (UEC) has indicated that it needs a sustained uranium price above $60 per pound to make it worthwhile to bring dormant operations in the US back into production. The capital-intensive expansion of uranium deposits such as Fission Uranium’s Tripple R deposit or Nexgen’s Rook I project in Canada also require sustainably higher uranium prices. A look at the uranium price shows that the market has begun to price in the coming shortages.

Source: Trading Economics

Kazakhstan’s Kazatomprom, the world’s largest uranium producer, has indicated that it will cut its production plan for 2024 due to difficulties in the availability of the sulphuric acid needed for uranium production. “Should the limited access to sulphuric acid continue throughout the year and should the company fail to meet the 2024 construction schedule at the newly developed deposits, Kazatomprom’s 2025 production plan could also be affected,” the company said.

Given the increasingly stressed uranium supply situation, we believe the investment risk is tilted to the positive. There are several opportunities for investors to invest in the sector. However, as with all “specialty sectors” with low trading volumes, caution is advised as the uranium price and share prices can be subject to significant fluctuations. A diversified investment in attractively valued explorers, developers and producers could, for example, be combined with a “trust” that invests in physical uranium (e.g. the Sprott Physical Uranium Trust). In the case of explorer and producer shares, which are more highly leveraged to the uranium price, detailed technical and financial bottom-up analyses should be carried out before investing to assess the technical and investment risks and “separate the wheat from the chaff”.