https://earth-investment.com/wp-content/uploads/2021/03/iStock-1039194006-1500x1000.jpg

https://earth-investment.com/wp-content/uploads/2021/03/iStock-1039194006-1500x1000.jpg

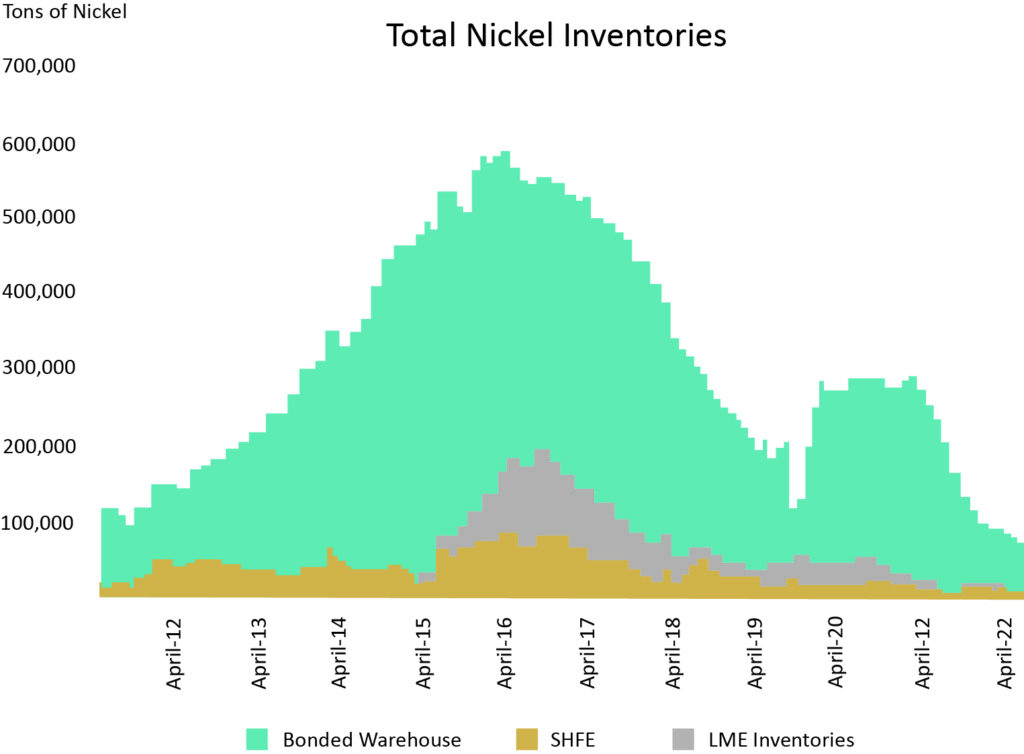

China’s State Reserve Bureau (SRB) will buy copper, nickel, and cobalt stocks in the second half of 2022, FastMarkets and Canadian analyst firm BMO report. Although exact purchase volumes are not yet known, the bulk of the stockpile is expected to be nickel as the bureau seeks to replace units used during the nickel shortage in March. With stocks of refined nickel still relatively low, officials may take the unusual step of buying units from the European market. Regardless of origin, the upcoming “official” purchases could also stimulate Chinese private sector demand. The latest LME [1] inventory data show that inventories remain well below historical averages (Figure 1).

Figure 1: Global Nickel inventories reached historic lows

Source: Scotia Bank, Bloomberg, LME, SHFE, COMEX & FastMarketsMB

Inventories of other metals also continue to fall. Zinc reported inventories down by more than 80% year-on-year, aluminum by more than 60%. Meanwhile, tin inventories fell to just 25 tons (from 230 tons at the end of May). During June, nickel was the only important metal to increase its inventories somewhat, but this increase of 3,200 tons is to be considered small compared to the overall market.

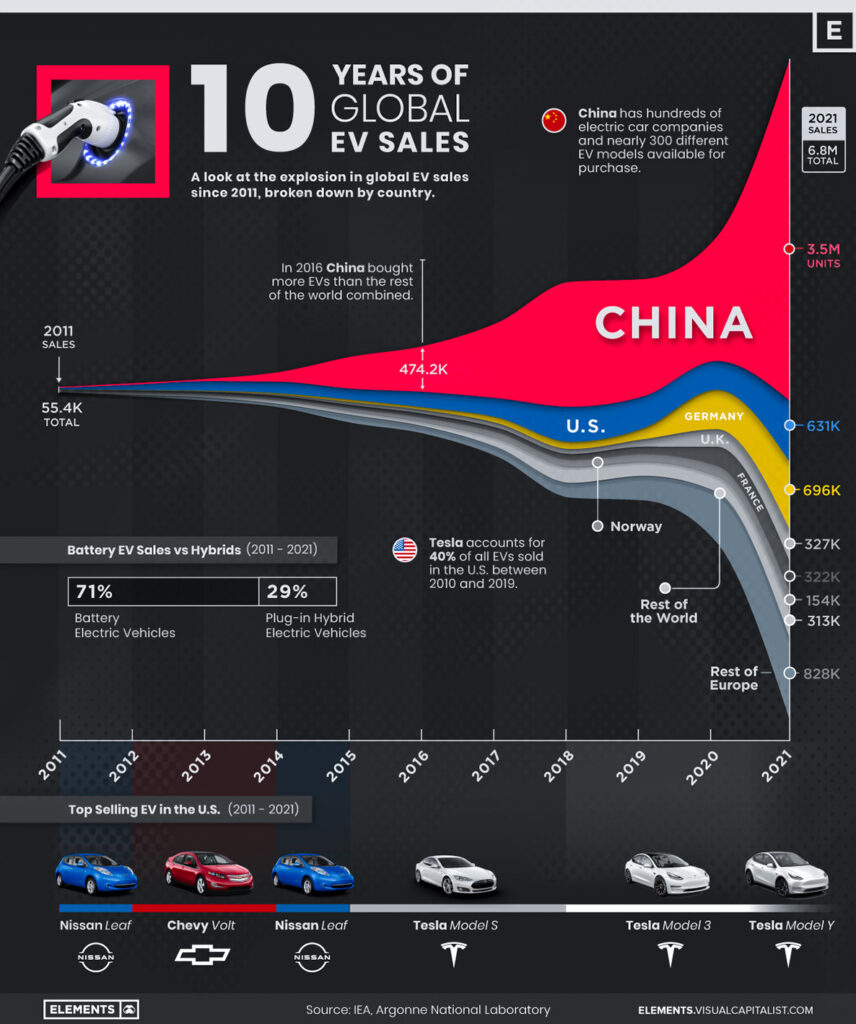

Nickel, cobalt, and copper are important metals for the production of electric cars. Chinese auto sales rose 30% year-on-year to an annual rate of 28.5 million units in July. This is according to the latest data from the China Association of Automobile Manufacturers. Although growth rates of New Energy Vehicles (NEVs) sales have slowed to +119% y/y (7.0mn units y/y), we still see NEVs as a positive growth story in China with a penetration rate of ~25% vs. 15% at this time last year. Given the falling inventories of these key metals coupled with the increase in e-car production (Figure 2), the projected buying of metals makes sense. Subsequently, this points to a reversal of this year’s malaise in the commodities sector (ex-oil and gas).

We would like to point out that high-quality deposits in copper, nickel, and cobalt are very scarce and new developments have been low over the last 10 years.

Figure 2: The exponential growth of electric car sales demand a large number of critical metals, including Nickel.

Source: Visual Capitalist

[1] LME = London Metal Exchange